Percentage of federal taxes taken out of paycheck

10 percent 12 percent 22 percent 24 percent 32 percent 35. Ad Compare Your 2022 Tax Bracket vs.

Financial Literacy Word Wall Consumer Math Math Word Walls Word Wall

To locate your percentage and base amount refer to the Publication 15 Percentage Method Table on the IRS website.

. How much federal tax is taken out of your paycheck will also be determined by your tax bracket the more income you earn the higher percentage tax bracket you might. There are seven different income tax brackets. See where that hard-earned money goes - Federal Income Tax Social Security and.

Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net earnings. The federal withholding tax has seven rates for 2021. Federal income taxes are paid in tiers.

Every pay period your employer will withhold 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. 10 12 22 24 32 35 and 37. Also What is the percentage of federal taxes taken out of a paycheck 2021.

Your 2021 Tax Bracket To See Whats Been Adjusted. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Discover Helpful Information And Resources On Taxes From AARP.

Income amounts up to 9950 singles 19900 married couples filing. Thats the deal only for federal income. How Your Paycheck Works.

For a single filer the first 9875 you earn is taxed at 10. The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket. For example if your gross pay is 4000 and your.

You owe tax at a progressive rate depending on how much you earn. What percentage of federal taxes is taken out of paycheck for 2020. These are the federal tax brackets for the taxes youll file in 2022 on the money you made in 2021.

FICA contributions are shared between the employee and the employer. Withholding from your paycheck is done on what is known as the graduated system. Also Know how much in taxes is taken out of my paycheck.

The federal income tax has seven tax rates for 2020. Supplemental tax rate remains 22. Backup withholding rate remains 24.

Add up all your tax payments and divide this amount by your gross pay to determine the percentage of tax you pay. This is divided up so that. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

The employer portion is 15 percent and the. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. The other federal taxes do have standard amounts they are as follows.

That 14 is your effective tax rate. There are also rate and bracket updates to the 2021 income tax withholding tables. Federal income tax and FICA tax.

62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62. 4 rows The withholding tables have tax brackets of 10 percent 12 percent 22 percent 24. 10 percent 12 percent 22 percent.

62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a. Your employer then will multiply 68076 by 15 percent 10211 and add the 1680 base amount. The federal withholding tax rate an employee owes depends on their income level and filing.

Your federal income tax withholding is 11891. What percentage of federal taxes is taken out of paycheck for 2020. The federal government receives 124 of an employees income each pay period for Social Security.

The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. The federal income tax has seven tax rates for 2020. Your employer will match that by.

These taxes are deducted from your paycheck in fixed percentages.

2022 Federal State Payroll Tax Rates For Employers

Consumer Math Activities Bundle Financial Literacy Consumer Math Consumer Math Activities Math Activities

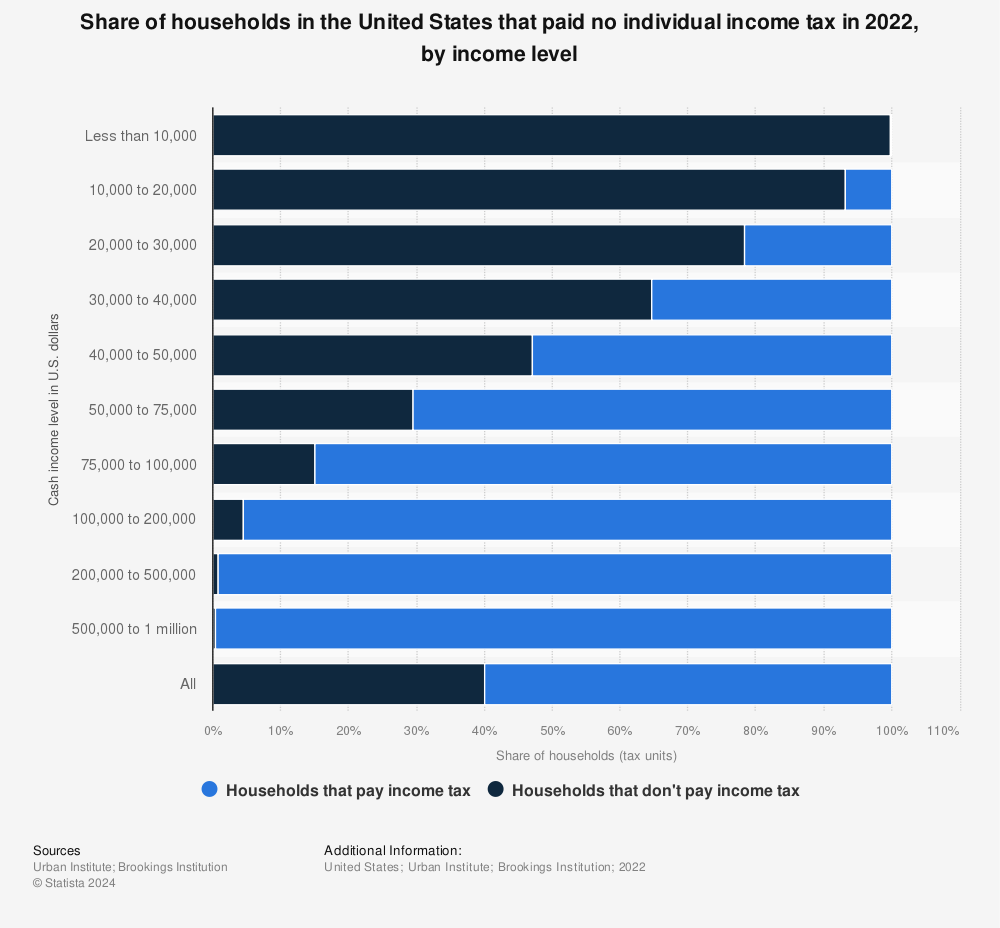

Percentages Of U S Households That Paid No Income Tax By Income Level 2021 Statista

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Explainer The 4 Trillion U S Government Relies On Individual Taxpayers Reuters

Gossary Of Finanical Terms Kahler Financial Financial Literacy Finance Class Financial Planning

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Calculate Federal Income Tax

Income Taxes What You Need To Know The New York Times

How To Calculate Payroll Taxes Taxes And Percentages

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

What You Need To Know Before Quitting Your Job To Start A Company Impuesto Sobre La Renta Contabilidad Cuentas Por Cobrar

How To Calculate Payroll Taxes Taxes And Percentages

Financial Literacy Word Wall Financial Literacy Word Wall Consumer Math

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor